Navigating the complex world of veterans affairs (VA) benefits can be difficult. From determining what benefits you’re eligible for, to figuring out what the VA considers “countable income,” accessing the benefits you need can turn into a confusing experience.

In this guide, you’ll receive a comprehensive overview of VA benefits, including the qualifying criteria, what types of income are considered countable income for VA benefits, and the income limits for this year. Additionally, we’ll touch on what next steps you can take if you find yourself ineligible for VA benefits. Let’s get started!

What are VA benefits?

VA benefits exist to honor — and provide tangible support — to the men and women who have served in the United States military. They include a range of services provided by the U.S. Department of Veterans Affairs (VA) to eligible veterans, their dependents, and survivors. Benefits include (but are not limited to) the following services:

- Healthcare: VA healthcare services are one of the most commonly used benefits by veterans. The VA has an extensive network of medical facilities to provide healthcare services to veterans and their families. Not only can veterans seek out services for primary, preventative, and emergency care, but they can also use VA healthcare services for specialized treatments, mental health services, and even long-term care.

- Disability Compensation: Veterans with injuries and disabilities they obtained during their service are entitled to collecting disability compensation. The amount depends on many factors — the severity of the disability, how it affects their daily activities, etc. — and is paid on a monthly basis.

- Home Loans: Another benefit many veterans tap into is VA home loan programs that assist veterans in buying a house. VA home loans make housing more affordable and accessible for veterans.

- VA Pension: This type of pension is a needs-based benefit that provides financial assistance to low-income veterans who are disabled and/or over the age of 65.

- Education and Training: There are educational assistance programs that cover tuition, fees, books, housing allowances, and other expenses while veterans pursue higher education.

How do you qualify for VA benefits?

Qualifications for VA benefits depend on what type of benefit you’re applying for because each benefit has a slightly different set of qualifications. In general, however, you must have served in the active military, naval, or air service, and you must have been discharged under conditions other than dishonorable. For certain benefits, you may need to meet specific service requirements, such as minimum active duty service periods during wartime or peacetime.

To gain a better understanding about VA benefit qualifications, here’s an overview of eligibility requirements for some of the most commonly used VA benefits.

Eligibility for VA health benefits

Eligibility for VA medical benefits depends on a few key factors.

Meet the minimum duty requirement. First, if you enlisted after September 7, 1980 or entered active duty after October 16, 1981, you generally need to have served for 24 non-stop months or the entire period of your active duty (some discharge exceptions may apply). If you served prior to September 7, 1980, the minimum duty requirement does not apply.

You’re a current or former member of the National Guard or Reserves. You must have been called to active duty by a federal order and completed the full duty. Active duty for training purposes only does not qualify at this time.

You served in the Vietnam War era. Certain time periods and locations apply, so research whether your service makes you eligible for VA health care.

You meet VA health benefits eligibility income requirements. You can qualify for VA health care based on your income.

Qualifications for VA pension

To be eligible for the Veterans pension program you must meet certain eligibility requirements. To start, you must have been discharged with anything other than a dishonorable discharge and your yearly income and net worth must meet certain limits. Learn more about 2023 VA pension rates for veterans.

Next, you must fall into one of the following categories:

- You served on active duty before September 8, 1980 with at least 90 days of consecutive military service and at least one day of that service must have occurred during a period of wartime. The VA has specific definitions of wartime periods, including World War II, the Korean War, the Vietnam War, the Gulf War, among others.

- After September 7, 1980 you started active duty and served at least 24 months or your full active duty order with at least one day during wartime.

- You served as an officer and began active duty after October 16, 1981 and you did not previously serve on active duty for at least 24 months.

Additionally, you must meet one of the following requirements:

- You have a permanent disability.

- You are 65 years or older.

- You live in a nursing home for long-term care because of your disability.

- You receive Supplemental Security Income or Social Security Disability Insurance.

It’s important to remember: VA pension is a needs-based benefit. It’s designed to assist veterans who have limited income and resources. To find out if you’re eligible, contact your local VA regional office or visit the VA website for information on the application process. Consult with a Veterans Service Officer (VSO) to make sure your application is thoroughly complete before submitting.

Requirements for VA home loan eligibility

There are certain eligibility requirements for VA home loan assistance (also known as a VA direct or VA-backed home loan). First, you must meet the minimum active-duty service requirements. If you don’t meet these service requirements, you may still be able to get a Certificate of Eligibility (COE) for a VA home loan. If you’re experiencing hardship, had an early out, experienced a reduction in force, have a service-related disability, or certain medical conditions you could still qualify.

Servicemembers in certain organizations may also qualify for a VA home loan, including being a Public Health Service officer, serving as a cadet in the U.S. military, air force, or coast guard, acting as midshipman at the U.S. Naval academy, serving as an officer of the National Oceanic and Atmospheric Administration, or being a merchant seaman during World War II.

If you meet eligibility requirements, then you can request a COE from the U.S. Department of Veterans Affairs. Once you receive a COE, you can find a VA-approved lender and get prequalified for a home loan amount. Then you can begin searching for a home.

What VA benefits are considered income?

The VA has certain income limits for benefits provided to veterans. It’s important to note that the VA evaluates “countable income” when assessing whether someone qualifies for VA benefits (or not), which can be different from the amount seen on your tax return. According to the U.S. Department of Veterans Affairs, a veteran’s “countable income” encompasses their earnings, which includes: Social Security benefits, investments, and retirement payments, plus any income received by their dependents. Here’s a more comprehensive breakdown of what the VA considers countable income:

- Wages: Any earnings you receive from employment or self-employment are counted as income.

- Alimony Payments: If you receive alimony from a former spouse, it is considered as countable income.

- Unemployment Compensation: Payments received through unemployment benefits are included in your countable income.

- Workers Compensation: If you receive payments as compensation for work-related injuries or disabilities, it counts towards your income.

- Pensions: Income from pensions — including military pensions or private pensions — is considered countable income.

- Social Security Benefits: Retirement benefits or disability payments received through Social Security are counted as income.

- Interest and Dividends: Any income earned through interest or dividends from investments is considered countable income.

- IRA Distributions: If you withdraw funds from your Individual Retirement Account (IRA), the amount withdrawn is included in your countable income.

- Business Income: Income derived from self-employment or business activities is considered countable income.

- Life Insurance Proceeds: If you receive a payout from a life insurance policy, it is counted towards your income.

- Residual Income: Residual income is the amount of money that remains after deducting certain expenses from the veteran’s gross income. The U.S. Department of Veterans Affairs considers residual income as a factor when determining a veteran’s eligibility for certain VA benefits programs.

Types of income excluded

There are certain types of income the VA does not include in “countable income.” These sources of income include:

- Caregiver Payments: Payments received as compensation for providing caregiving services are excluded from countable income.

- FEMA Payments: Financial assistance received from the Federal Emergency Management Agency (FEMA) due to disaster-related circumstances is not counted as income.

- Casualty Insurance Proceeds: Payments received from casualty insurance, such as for property damage or loss, are excluded from countable income.

- Scholarships: Funds received as scholarships for education or training purposes are not considered as income for VA benefits eligibility.

- Relocation Expenses: Reimbursements or payments received for relocation expenses are excluded from countable income.

- VA Pension Payments: Payments received as VA pension benefits are not counted as income for determining eligibility for other VA benefits.

- Welfare: Payments received through welfare programs are excluded from countable income for VA benefits eligibility.

- Supplemental Security Income (SSI): SSI payments, which provide financial assistance to individuals with low income and limited resources, do not count as income for VA benefits purposes.

- Withheld Social Security Overpayments: If your Social Security benefits were previously overpaid and are being withheld to recover the overpayment, these withheld amounts are not considered as countable income.

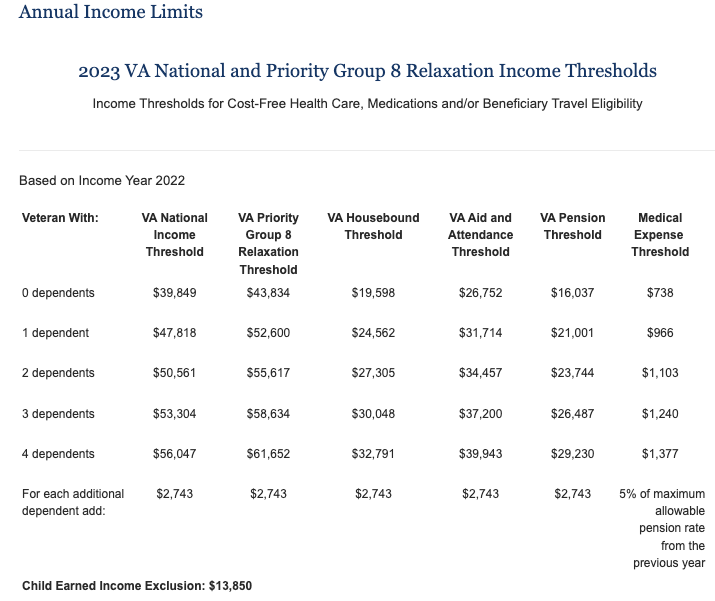

2023 Income Limits

Every year the VA updates its national income thresholds for receiving certain VA benefits to make sure that the benefits provided to veterans are aligned with inflation, wages, and the cost of living. These VA qualifications income requirements are published annually online.

In 2023, the VA National Income Thresholds is as follows:

- $38,849 or less if you have no dependents

- $47,818 or less if you have one dependent

- $50,561 or less if you have two dependents

- $53,304 or less if you have three dependents

- $56,047 or less if you have four dependents

For every dependent after 4, add an additional $2,743.

Remember: these VA income guidelines include “countable income” only (minus any allowable deductions). If your countable income is higher than the national income threshold, you may still qualify for partial benefits depending on what priority group you’re in. Learn more about priority groups to see what group you fall into by visiting the Veterans Affairs website.

Source: 2023 VA National and Priority Group 8 Relaxation Income Thresholds

What do you do if you’re ineligible for VA benefits?

If you’re ineligible for VA benefits, there are resources and support groups that may be available to you. While VA benefits are designed for veterans and their eligible dependents, there are other ways to get healthcare, housing, and other financial assistance. Here are a few ways to seek the help you need.

1. Reach out to nonprofit organizations dedicated to helping veterans.

There are many nonprofits and charities designed to help veterans and their families through financial hardships. Reach out and let them know how they can help you. Here are some noteworthy organizations to start with:

- Wounded Warrior Project

- Operation Homefront

- Disabled American Veterans (DAV)

- Fisher House Foundation

- Folds of Honor

- Operation FINALLY HOME

2. Seek assistance from state organizations.

Generally states offer veteran-specific aid, regardless of VA benefit eligibility. For example, Texas has the Texas Veterans Commission (TVC) that provides a range of services to veterans. Florida’s Department of Veteran’ Affairs is another example of state-run programming for veterans. From financial assistance and healthcare services to employment support and housing assistance, these state-run organizations want to help local veterans.

3. Consider selling your life insurance policy.

Oftentimes folks purchase their life insurance policy during a time of high need to protect loved ones in case of an emergency. However, as life progresses, you may find that you no longer need your life insurance policy like you once did. If your loved ones are no longer financially dependent on you — or if they have even passed on — you may want to consider selling your policy for a cash payout. This is called a life settlement and it can provide a significantly higher payout than surrendering your policy. Here’s a look at the difference between selling your life insurance policy and surrendering it — and what the financial benefits may be when selling it.

- A life settlement transfers policy ownership. When you sell your life insurance to a trusted third party such as a life settlement provider, they become the policyowner instead of you. The life settlement provider becomes responsible for paying the premiums on the policy and they will collect the death benefit upon your passing.

- A life settlement typically pays more than surrendering a policy. The average payout of a life settlement is, on average, four times higher than surrendering the policy back to the insurance carrier.

- Not everyone qualifies for a life settlement. Unlike surrendering a policy back to the insurance carrier, a life settlement has certain requirements the insured must meet before the policy can be sold. Generally speaking, if you’ve had a change in health since you took out your life insurance policy and if your policy has more than a $100,000 death benefit, you’re likely to qualify. To find out if you qualify — and to see how much your policy may be worth — have your policy evaluated by the life settlement experts at Coventry.

4. Reach out to job placement services.

Career centers are designed to help you find suitable employment opportunities so you can gain financial stability. Explore state workforce agencies or veterans’ employment programs for job search assistance.

5. Explore community support.

Your local community may have veterans’ advocate groups and services clubs you can join that provide a network of support and connections to resources. Not only are these organizations wonderful sources of camaraderie, but they can also introduce you to financial aid you didn’t know existed in your area. Visit one of these community-based organizations to see how they may assist you.

VA Benefits for Veterans

The journey of a veteran is filled with sacrifice, resilience, and dedication. It’s with the utmost importance that veterans receive the support they need in their post-military lives. VA benefits exist to help veterans gain access to the comprehensive healthcare, financial aid, educational opportunities, and housing assistance they need to thrive in the U.S. If you’re a veteran, remember that you’re not alone on your journey. There are resources available to address your unique needs and challenges. From state-provided benefits to financial innovations like selling your life insurance policy in a life settlement, lean on the resources provided and, most importantly, continue to make your mark in this world. Thank you for your service.