Bloomberg reports that the top 1% earn 21% of total income in the U.S., with the income distribution becoming more severe year on year. With the widening wealth gap permeating the news cycle, our team at Coventry was curious to investigate:

- Where in the U.S. is immense wealth being perpetuated from one generation to the next through large trust funds and bountiful inheritance?

- Where is the average citizen’s net worth the highest in the U.S. due to lucrative professions and investment holdings?

- Where is socio-economic status flouted most through million-dollar homes and large-scale private school attendance?

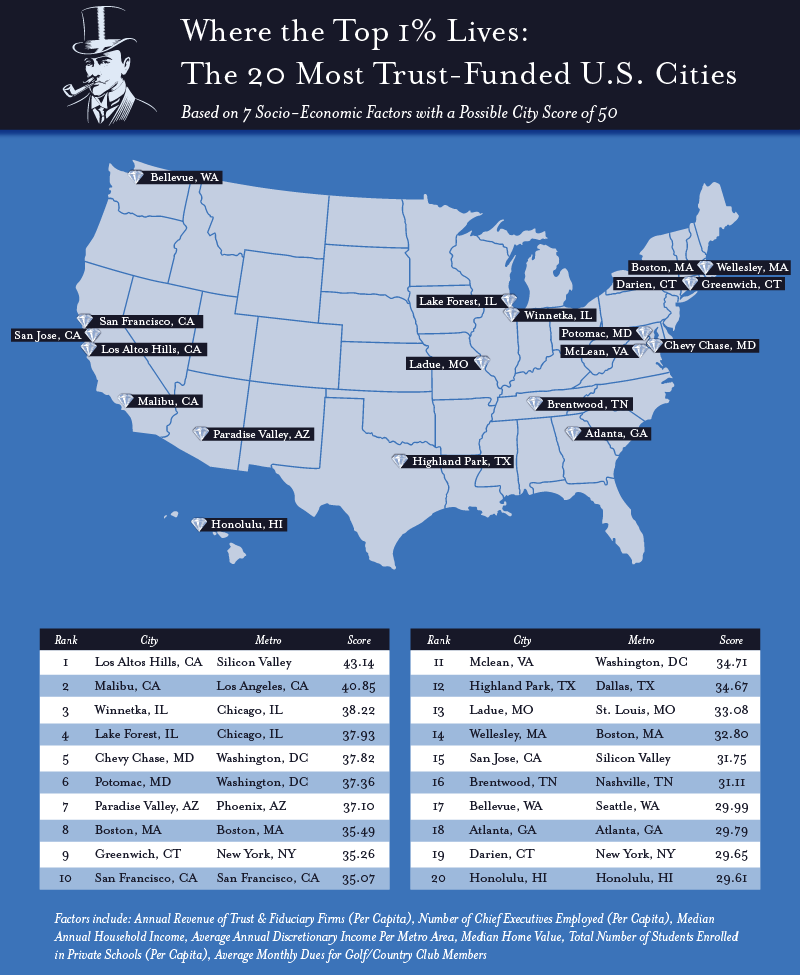

To answer these questions and more, we’ve ranked 50 U.S. cities from Bloomberg’s richest cities index on a set of financial and socio-economic criteria to determine the most “trust-funded” or wealthiest cities around the U.S.

Methodology

To find the most “trust-funded” cities in the U.S., we’ve looked at 7 socio-economic factors by city.

(1) Annual revenue of trust & fiduciary firms (per capita)

(2) Number of chief executives employed per metro area (per capita)

(3) Median annual household income

(4) Average annual discretionary income per metro area

(5) Median home value

(6) Number of private school attendees (per capita)

(7) Average monthly dues for golf/country club members

We assigned weights to each factor based on their level of contribution towards enormous wealth. Heavier weights were assigned to financial and employment-related factors in each city such as sales revenue of trust firms and annual household income, while lower weights were assigned to factors such as median home value, private school attendance, and country club fees. Lastly, we calculated the sum of the seven weighted factors, which gave us an overall “opulence” score for each city. The highest possible city score was 50.

The ranking factors are listed below with their respective weights and source data:

- Annual revenue of trust & fiduciary firms (per capita)

- Source: U.S. Census

- Weight: 2.0

- Number of chief executives employed per metro area (per capita)

- Source: U.S. Bureau of Labor Statistics

- Weight: 2.0

- Median annual household income

- Source: U.S. Census

- Weight: 2.0

- Average annual discretionary income per metro area

- Source: U.S. Bureau of Labor Statistics

- Weight: 1.0

- Median home value

- Source: City-data.com

- Weight: 1.0

- Number of private school attendees (per capita)

- Source: Private School Review

- Weight: 1.0

- Average monthly dues for golf/country club members

- Source: Individual club websites & HowMuchIsIt.Org

- Weight: 1.0

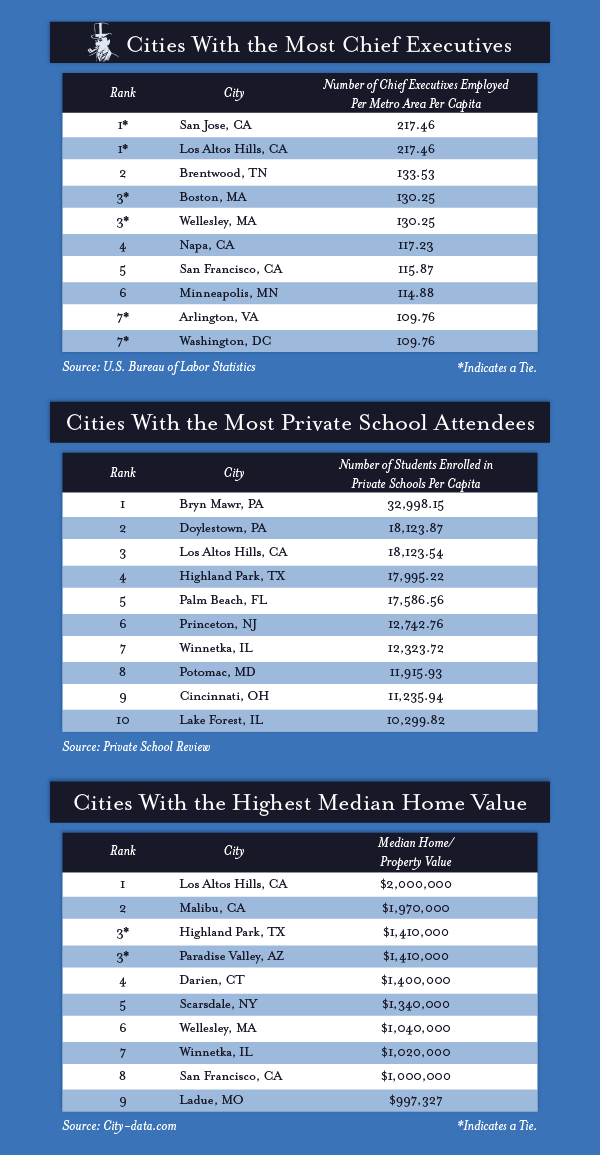

Los Altos Hills, CA, one of Silicon Valley’s most affluent suburbs, tops our list as the #1 most trust-funded city in the U.S., with a median home value of over 2 million dollars and a median household income of $248,218. In this area, you’ll find sprawling, Tuscan estates with panoramic views fit for Architectural Digest as well as reasonable commutes to the campuses of Facebook, Google, and Apple. Monthly golf & country club dues are upwards of $950 and the greater metropolitan area employs over 4,200 chief executives like Google’s CEO, Sundar Pichai, and HP’s co-founder, David Packard.

With their Tudor-style mansions and their ivy-covered gates, two Chicago suburbs, Winnetka, IL & Lake Forest, IL also made it to our top ten list. Winnetka boasts a median household income of $216,875, where the average home is priced at $1.02 million. Additionally, 12% of the city’s youth population attends a private school. Overall, Chicago’s North Shore, which includes Winnetka and Lake Forest, is considered one of the most well-educated and wealthiest areas in the U.S.

Several Washington D.C. suburbs landed in the top 20 spots for most trust-funded cities, including Chevy Chase, MD, Potomac, MD, and McLean, VA. Boston, MA ranks #8 on our list, given all trust & fiduciary firms within the Boston metro area earn over 5.25 billion dollars in annual revenue. What’s more, Boston is home to 6,520 chief executives and 28,367 private school students (kindergarten through high school).

Greenwich, CT, #9, and Darien, CT, #19, well-known for hedge funds and easy commutes into New York City, have median household incomes of $138,492 and $208,848, respectively. Additionally, Highland Park, TX, home to oil-mining and gas millionaires, ranks twelfth on our list.

To sum up, titans of wealth are relatively well distributed throughout the U.S., from Palm Beach, FL to Ladue, MO to Paradise Valley, AZ. Many of these cities also represent areas where income disparity is the largest, especially within areas around New York, San Francisco, and Washington D.C., where the top 1% earns 515k plus annually, but the average annual income hovers around $41k.

Not in the top 1% and over 65? Why not turn your life insurance policy into a financial asset by selling it for cash that you spend the way you want to? Find out if you qualify!

Full Data

Interested in diving deeper into the numbers for the top 20 cities, or wanting to see how your city stacks up if it’s not on the above map? We’ve compiled our full data study for the 50 wealthiest cities in the United States into the interactive data table below. Just click on the heading of each column to sort by that category!