‘Til death do us part, right? Or at least that’s what they often say about marriage. Many Americans look forward to a seasoned love that results in side-by-side porch chairs, grandchildren, and retirement cruises. And for many, that dream comes true—but not everyone. Vows can be broken by runaway brides and grooms with cold feet, and love can wilt and die like unwatered plants, left in too much sun.

With obstacles of love strewn throughout life, the saltiest cynics and mushiest romantics can unite around the same dream: someone to grow old with.

So, where in the U.S. are Americans buying into the concept of “forever” and where is “forever” going up in smoke?

Methodology

To find out, the team at Coventry Direct turned to the U.S. Census and collected data on the number of separated, divorced, and married men and women, aged 55 and older, in all 50 states, the District of Columbia, and Puerto Rico. We then converted those numbers to the percentage of the overall state population.

Read on to see where Americans are growing old together–and where they’re getting out early!

The States That Grow Old Together

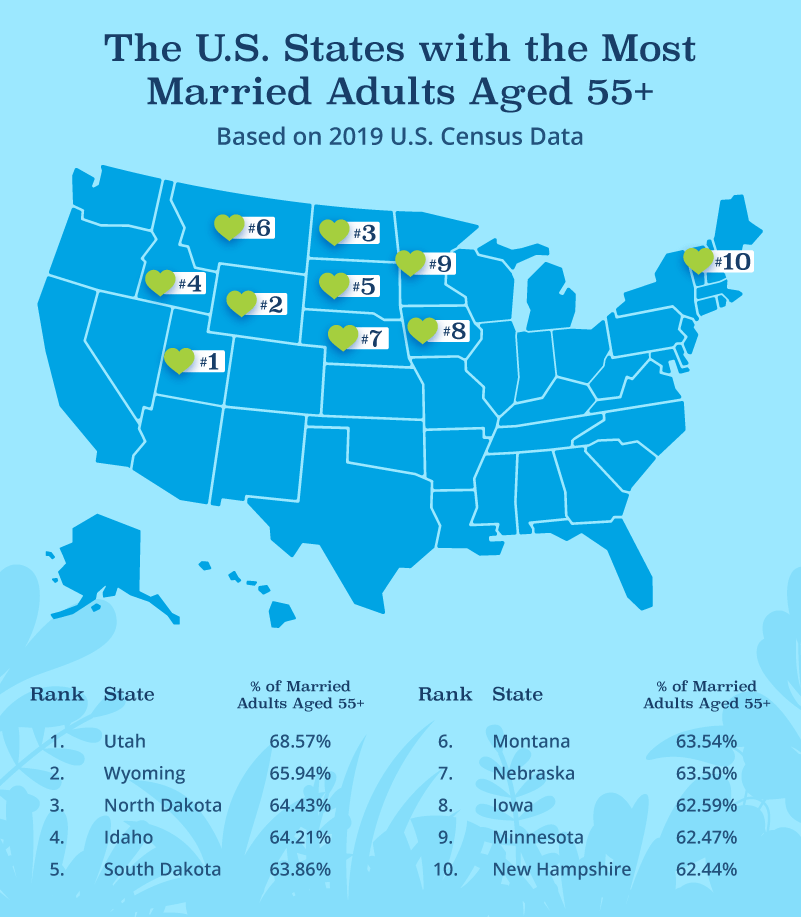

Love is alive in America’s Heartland. Half of the states with high percentages of married older adults are in middle America—North Dakota, South Dakota, Nebraska, Iowa, and Minnesota—where family and personal relationships take pride of place among the region’s more traditional values. Both North and South Dakota rank among the top five states for growing old together, with 64.43% and 63.86%, respectively. The Great Plains? More like Lover’s Lane (a really big one).

With winding canyons, red rock spires, and striking mountains as the backdrop for romance, Utah leads the country in marriages remaining intact at 55 and older, at 68.57%. Given that the state also has the highest population of practicing Mormons in the country, marriage may have stronger religious underpinnings in Utah.

New Hampshire is the only state in the eastern part of the U.S. to make the ranking for long-lasting marriages. Famous for its extensive granite formations and quarries, the Granite State boasts a high percentage of marriages that are just as rock-solid, at 62.44%.

The States That Grow Apart

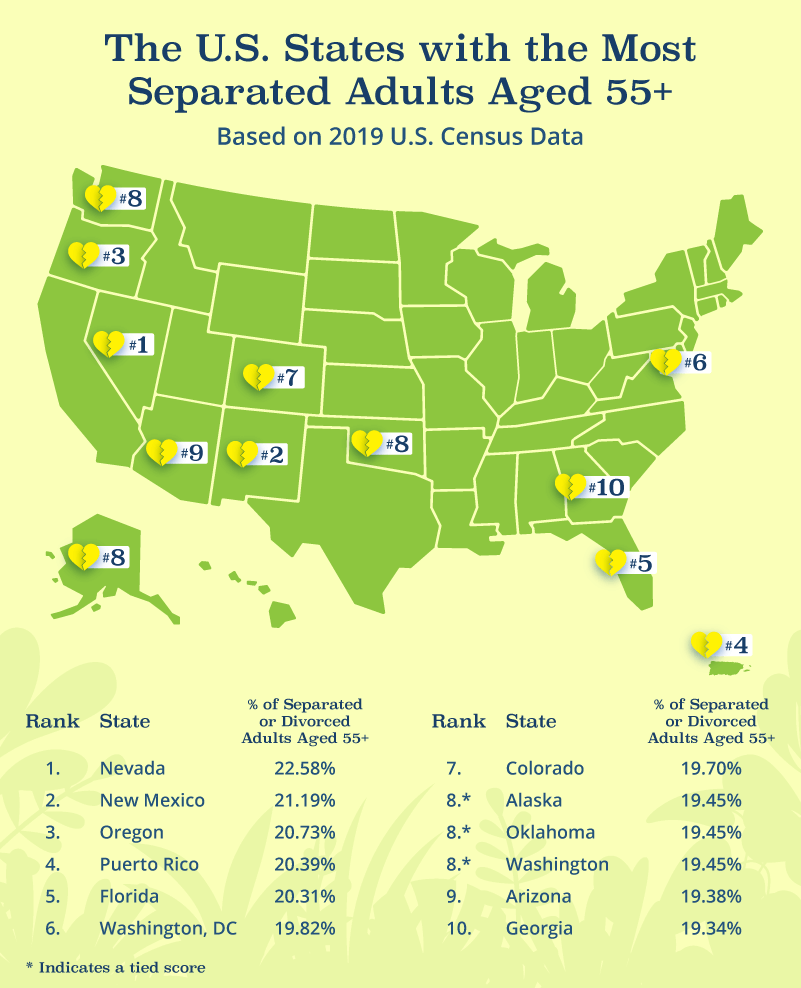

Check-ins at the Heartbreak Hotel are higher for older adults in states like New Mexico, Georgia, Oregon, and Colorado. Nevada, home to Las Vegas and its myriad drive-thru altars and chapels of love, sees things more clearly in the daytime; 22.58% of adults aged 55+ in the state are separated or divorced.

In Washington, D.C., cherry blossom season fades to stifling summers too hot for holding a lover close; 19.82% of adults aged 55+ in the nation’s capital are separated or divorced. While the beaches of Puerto Rico may make for a romantic getaway, the honeymoon is certainly over for 20.39% of older adults there.

States like Arizona and Florida, popular retirement destinations due to their appealing climates and relative tax friendliness, also have high percentages of failed marriages, at 19.38% and 20.31%, respectively. Still, it’s possible that the higher proportion of older adults in these states accounts for the higher divorce rates. Retirement just got a little less relaxing.

Final Thoughts

Growing old with someone requires more than just romance and a dozen roses every now and then. You and your partner may also be considering how to sell a life insurance policy for cash. Plan financially for your long-lasting love with the folks at Coventry Direct who can help you turn an outdated life insurance policy into cash—spend less time worrying about money and more time with your one and only!