There’s many different types of life insurance you can choose from when purchasing a policy. Our guide to life insurance policies can help you figure out which option best fits your needs.

There are two main types of life insurance that you can buy as an individual, independent from an employer. Term life insurance and whole life insurance are both viable ways to provide financial support to loved ones after your death. However, there are some key differences between these types of life insurance coverage.

Types of Life Insurance:

Life Insurance Type #1: Term Life Insurance Policy

A term life insurance policy is your simplest option. You choose how long you want the policy to last and the level of coverage. When the policy goes into force, you’ll begin paying premiums. Most life insurance companies allow you to pay monthly, quarterly, or annually. There may be discounts available if you pay your premiums annually, in advance.

If you die while the policy is in force and your premium payments are up-to-date, the person you designated as the beneficiary will receive the death benefit. If the policy term expires while you are still alive, the policy will terminate and you will no longer have coverage. At this point, you can choose to initiate another policy or go without life insurance.

Who Buys Term Life Insurance?

Younger people who want life insurance but need a simple and inexpensive option that will provide income replacement if they die find that term life insurance is an ideal choice.

Families with children at home who want to be able to replace the income of one or both spouses in the event of a death may buy a term life insurance policy on each parent that would provide the surviving parent with financial means to continue living in the family home and pay for the kids’ education.

Older people who want to provide money for their children to cover funeral expenses may purchase a small term life insurance policy because it’s inexpensive.

Right now, rates for term life insurance are near a 20-year low. It’s easy to get a policy online, and the simplicity of this financial product makes it a good fit for people who want an easy-to-understand life insurance policy with straightforward terms at a low price.

Pros

- Inexpensive policy that allows young and healthy people to get the most possible coverage even if they don't have a lot of extra room in their budget

- Uncomplicated life insurance product that operates on simple principles

- Generally convertible for a period of time to a permanent product keeping the same issue class without updating the medical underwriting

- Premiums generally remain the same for the entire term of the policy

Cons

- The insured person can outlive the policy

- Getting a new policy becomes more expensive according to the insured person's age and health status

- When the policy term expires, the death benefit is no longer available

Types of Term Life Insurance Policies

Guaranteed Term Life Insurance

With this type of coverage, the premium stays the same throughout the life of the policy.

Modified Term Life Insurance

Premiums may go up over time, as part of a specialized financial plan.

Convertible Term Life Insurance

At the end of the term, the policyholder can choose to convert the term policy to a permanent policy for a predetermined increase in premium. In this scenario, the insured person will not go through underwriting when they decide to convert the policy.

Family Income Benefit Term Insurance

With this type of term policy, the death benefit is paid over time instead of in one lump sum.

Decreasing Term Life Insurance

As time passes, this policy’s death benefit shrinks. Premiums remain the same throughout the life of the policy. This type of life insurance may work well for people who have a lot of debt or young children at home but won’t have those financial concerns 10-20 years from now.

Return of Premium Life Insurance

If the insured person outlives their term life insurance policy and they have return of premium coverage, they can receive a portion of the premiums paid as a refund.

Annual Renewable Term Life Insurance

For people who don’t need a longer-term policy, this coverage works well. The premiums increase each year, so it’s not a good choice to insure someone for more than a few years.

Do you own a life insurance policy you no longer need? You can sell it for cash!

Life Insurance Type #2: Permanent Life Insurance Policy

The second main type of life insurance is permanent life insurance. There are three main types of life insurance that fall under the category of permanent life insurance: traditional whole life, variable life and universal life. As the name suggests, this kind of policy remains in force as long as the premium payments are up-to-date.

Who Buys Permanent Life Insurance?

People with large estates may use permanent life insurance policies to help create a tax shelter. Life insurance proceeds paid to your beneficiary are not taxable. For this reason, those with large estates can use this type of life insurance policy to spare their loved ones from giving up a large chunk of money to estate taxes. The Tax Cuts and Jobs Act of 2017 doubled the estate tax exclusion. Unless you have more than $11.4 million to leave to your loved ones (or $22.8 million per married couple), they won’t have to worry about paying estate taxes.

Types of Permanent Life Insurance

There are three main types of permanent life insurance policies: whole, variable, and universal.

Whole Life Insurance Policies

There are two parts to a whole life insurance policy: your death benefit, which is provided to your beneficiaries, and a savings vessel that grows over time. A portion of each of your premium payments goes into this fund to cover fees associated with managing the account.

A large portion of your premium covers front-loaded fees during the first years. Eventually, you can borrow against life insurance which is the policy’s cash value. Doing so reduces the death benefit and the policy’s cash value. If the policy grows large enough, you’ll have the option of surrendering all or part of it in exchange for the built-up cash value. At this point, you’ll pay a surrender fee and possibly pay taxes on the amount of money you get out of the policy.

Whole life insurance policies pay dividends to policyholders. Also called participating policy contracts, these policies allow owners to participate in the success of the life insurance company by collecting a portion of the company’s profits.

Insurance companies distribute dividends from a participating policy contract in a few ways:

- The dividend is subtracted from the policy premium

- Policyholders receive a check for the amount of the dividend

- Policyholders can use the money to purchase more insurance

- The dividend can be invested with the insurance company and earn interest

Pros

- Offers a proven tax shelter for those with estates worth more than $11.4 million (or $22.8 million per married couple)

- Policy owners can take out a policy loan against the accumulated cash value

- Coverage remains as long as premiums payments are up-to-date, regardless of health status

Cons

- Complicated investment and death benefit combination is confusing for most consumers

- Fees compromise the fund's growth, especially during the first years

- High costs make whole life insurance premiums too expensive for many people to maintain throughout their lifetimes

- Whole life insurance costs are typically four to 10 times higher than term life insurance

Variable Life Insurance Policies

The cash value of variable life insurance policies is subject to investment gains and losses. Since it depends on market rates, this type of life insurance has more potential to earn money but also comes with more risk. Fees are generally lower with variable life insurance than with whole life insurance, but the policyholder must be able to tolerate the possibility of losing money.

While variable life insurance provides a means by which to invest in certain funds that may produce gains over time, it’s a complicated financial product with limited investment options. Those considering this type of insurance should be sure they can pay the expensive premiums far into the future to avoid allowing the policy to lapse.

Do you own a life insurance policy you no longer need? You can sell it for cash!

Universal Life Insurance Policies

With this type of policy, you’ll get an investment account and a death benefit. The policy premium depends on the face value of the policy, the insurance company’s fees, and the amount of money you’ll add to the savings portion of the policy.

Universal life insurance policies pay interest on your savings. Policyholders have the option to change the death benefit and premium while keeping the same policy. Increasing the death benefit may trigger underwriting that could include medical questions and a medical exam. There may be additional fees if the policyholder wants to decrease the death benefit.

At some point, there may be enough cash value built up inside the policy to skip payments and let the value of the policy pay the premiums. When the current market rates fall to the guaranteed minimum rate, premiums must increase so the cash value of the policy continues to grow as planned.

Guaranteed universal life insurance is the least expensive type of universal life insurance. It accumulates cash value at the slowest rate. The policy lasts until its owner is 90, 95, 100, 110 or 121.

While the interest rate on the funds held in this policy is variable, there is a minimum rate. Premiums are flexible, and these products are very attractive because the insurance carrier can never change the fees associated with the policy. You can maintain the death benefit with a minimum payment, but if you want the account to accumulate cash value, you must make larger premium payments.

Variable universal life insurance is a combination of a universal life policy and a variable life policy. This type of life insurance is both flexible and variable. The death benefit may go up or down according to the performance of the account. This complex form of life insurance is best for those with high incomes who enjoy the benefit of comprehensive financial management services.

Indexed universal life insurance policies base performance on various financial benchmarks, like the S&P 500. Although you can’t lose money on this account, growth could remain flat for long periods when the markets perform poorly. This type of life insurance has become more popular in recent years because of the no-lose guarantee. It also has the potential to perform well under the right circumstances.

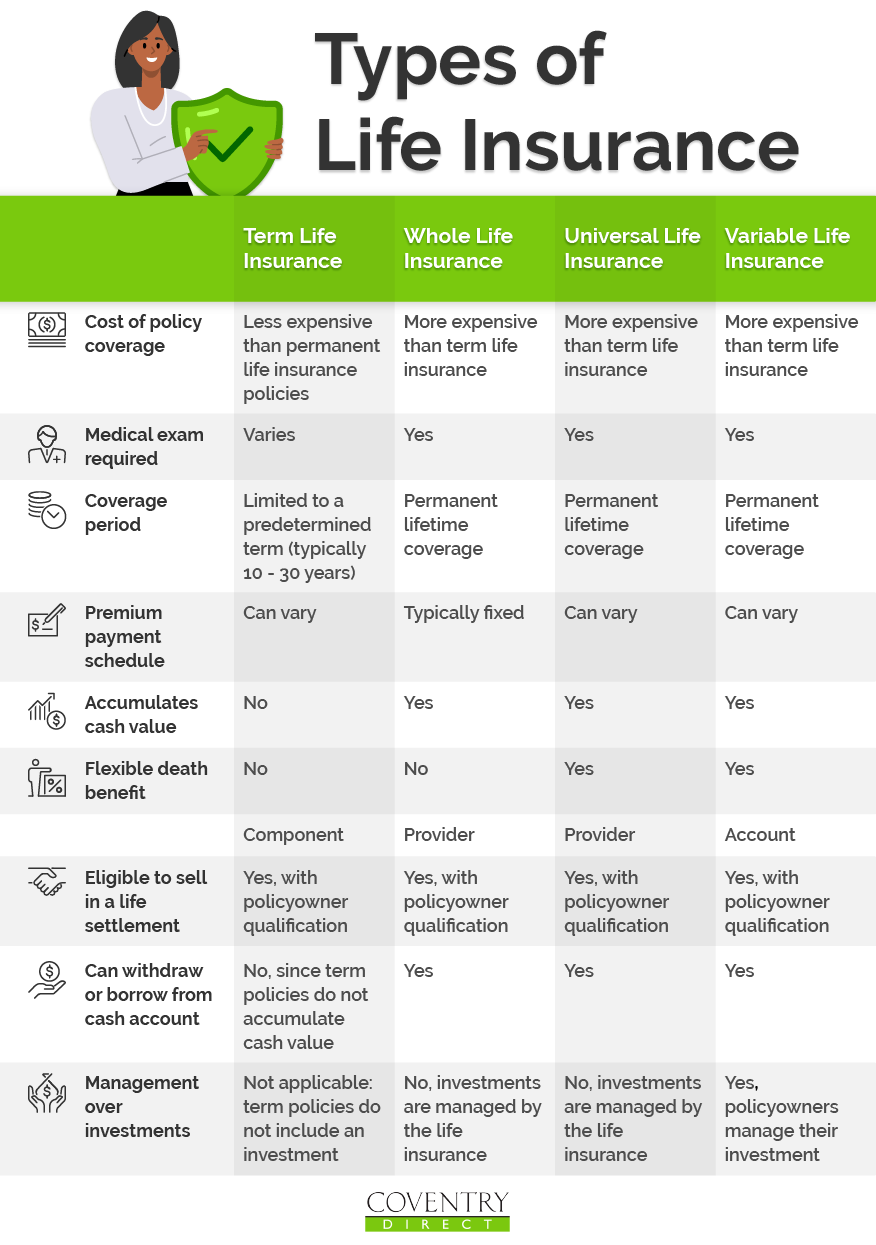

Comparing Different Types of Life Insurance

As you compare what kind of life insurance may work best for you, it may be easier to review the types of life insurance and their benefits side-by-side. Here’s a life insurance comparison chart to help you decide which type of life insurance policy may work best for your current needs and long-term goals.

Accelerated Benefit Riders

Available on both whole and term life insurance policies, accelerated benefit riders are “add-ons” allowing policyholders to access a portion of their death benefit under certain circumstances while they are still alive. If the insured person has to make a permanent move to a nursing facility, becomes chronically or terminally ill, or becomes disabled, they’ll have an additional source of cash.

For those that aren’t eligible for disability insurance or a long-term care policy, accelerated benefit riders can provide a much-needed source of funds. Of course, accessing the death benefit reduces the amount of money received by beneficiaries when the insured person dies.

A note about beneficiaries

No matter who you decide to name as beneficiary on your life insurance policy, it’s crucial to keep your policy documents in a safe and easily-accessible location. Let your beneficiaries know that they are named in your life insurance policy and tell them where they can find the paperwork if you die.

It’s the beneficiary’s responsibility to present the life insurance company with a copy of the insured person’s death certificate so they can claim the payout. There is about $7.4 billion of life insurance money in the United States currently unclaimed. If your loved ones don’t know about your life insurance policy, they won’t have any way to access the money you wanted them to have upon your death.

A note about insurance companies

While it’s important to get quotes for the type of life insurance that you feel suits your situation, it’s also crucial to look closely at the insurance company. You expect your life insurance policy to remain in force as long as you want it and willing to make the premium payments, so it makes sense to verify that the company is financially solvent and responsible to their policyholders.

Check with A.M. Best and Standard and Poor’s to learn about the company’s ratings. Higher ratings indicate that the company is more financially secure.