For too many, debt is an ever-present worry hanging over their lives. Student loans, mortgages, credit card debt—practically every single life stage presents situations in which people can fall under this burden. Especially for those with fixed retirement incomes, debt represents a serious financial threat and source of anxiety.

No matter your age, removing this responsibility from your life is beneficial for your finances and your peace of mind. Life insurance policies make this relief possible by offering several ways to access the funds you need to pay off your bills like selling your life insurance policy. You can even borrow against life insurance—accessing some of your policy’s accumulated cash value for funds you can use to lower your debt. In this post, explore the ins and outs of borrowing from your life insurance to pay off debt: the process, qualifications, benefits, drawbacks, and, importantly, the potential payoff.

Can You Borrow Against A Life Insurance Policy?

Not only is borrowing against life insurance possible, but it can provide substantial cash for those with qualifying policies. While taking out a loan may seem a counterintuitive solution to looming debt, insurance policy loans are a commonly-used financial solution since they do not require policyowners to meet a certain credit score or provide justification for the loan.

In fact, life insurance policy loans offer several advantages that make them particularly attractive to those with standing debt. Unlike a traditional loan, policyowners who borrow money from their life insurance only have an obligation to repay the interest on the policy loan and can choose to repay none of the principal loan amount. When the policyowner dies, any outstanding loan balance will be deducted from the policy’s death benefits. If they do choose to repay the principal, they can do this with the comfort of knowing that all of the money is going back into their policy.

The net result: instead of repaying a lender, policyowners repay themselves.

However, these loans are not available to everyone. To take out a loan, policyowners must have life insurance that accumulates cash value, such as a permanent life insurance policy. These types of policies allow them to borrow a portion of the accrued sum to spend any way the policyowner wishes, using the cash value as loan collateral. Policies that don’t accrue cash values, such as term life insurance policies, lack the collateral for policyowners to borrow against.

How to Borrow Against Life Insurance to Pay Off Debt

For those worrying about how to cash in a life insurance policy by borrowing against their insurance, it’s time to breathe a sigh of relief. The process of acquiring a policy loan is quick and easy to follow from start to finish.

You can begin by speaking to your insurance company. Your insurer’s loan officers can guide you through the lending process, help identify whether your policy is eligible, and determine the potential sum of the policy loan. Once they have ensured you have a cash value policy, you can ask the loan officer to send you an in-force illustration. This document informs policyowners of their life insurance’s current cash value (how much their policy is worth) and the estimated future cash value (the sum they could receive by borrowing against life insurance).

All you then have to do to finish the loan process is complete a policy loan request. First, contact the loan officer to have them send you this document. Next, fill out, sign, and return it to the insurance company, including information such as your name, policy details, and the amount you would like to borrow. If your request is approved, you can expect to receive the loan amount in the form of a check about a week later.

What Types of Life Insurance Policies Allow Borrowing?

Not all types of life insurance are eligible for policy loans. Because the policy’s cash value acts as the loan’s collateral, policyowners can only borrow from life insurance to pay off debt when their policies accrue money. Only policyowners with permanent life insurance policies, such as whole and universal life insurance, are eligible for this type of loan.

Can you borrow money from term life insurance?

Though term life insurance is another popular option, these policies do not qualify for policy loans as they do not accrue inherent cash values. If policyowners tried to borrow against this type of life insurance, they would have no cash sum to draw on as the collateral of their loan.

How Much Can You Borrow Against Your Life Insurance Policy?

The question of how much you can borrow against your life insurance policy is likely top of mind for those considering this option. As in policy eligibility, the answer to this important question comes down to the policy’s cash value. The amount you can borrow against life insurance is bound by the cash value accumulated on the policy. Policyowners can expect to borrow a substantial portion of this sum.

What Kinds of Debt Can Be Paid Off When You Borrow Against Life Insurance?

When it comes to using the cash from a life insurance policy loan to repay your debt obligations, no kind of debt is exempt. From student loans to credit card debt, this method of cashing in on your life insurance policy provides complete flexibility and allows you to pay off whatever debt you want.

Typically, policyowners repay their most urgent obligations first, meaning those with the most unfavorable terms and highest payments. However, in the end, the choice is yours. If you are feeling the pressure of mounting bank loans, feel free to use the cash advance from your policy loan to lower or completely pay off this expense. Conversely, if you are carrying a large balance on your credit card and incurring expensive interest and fees, you can use your borrowed funds to pay down your credit card debt.

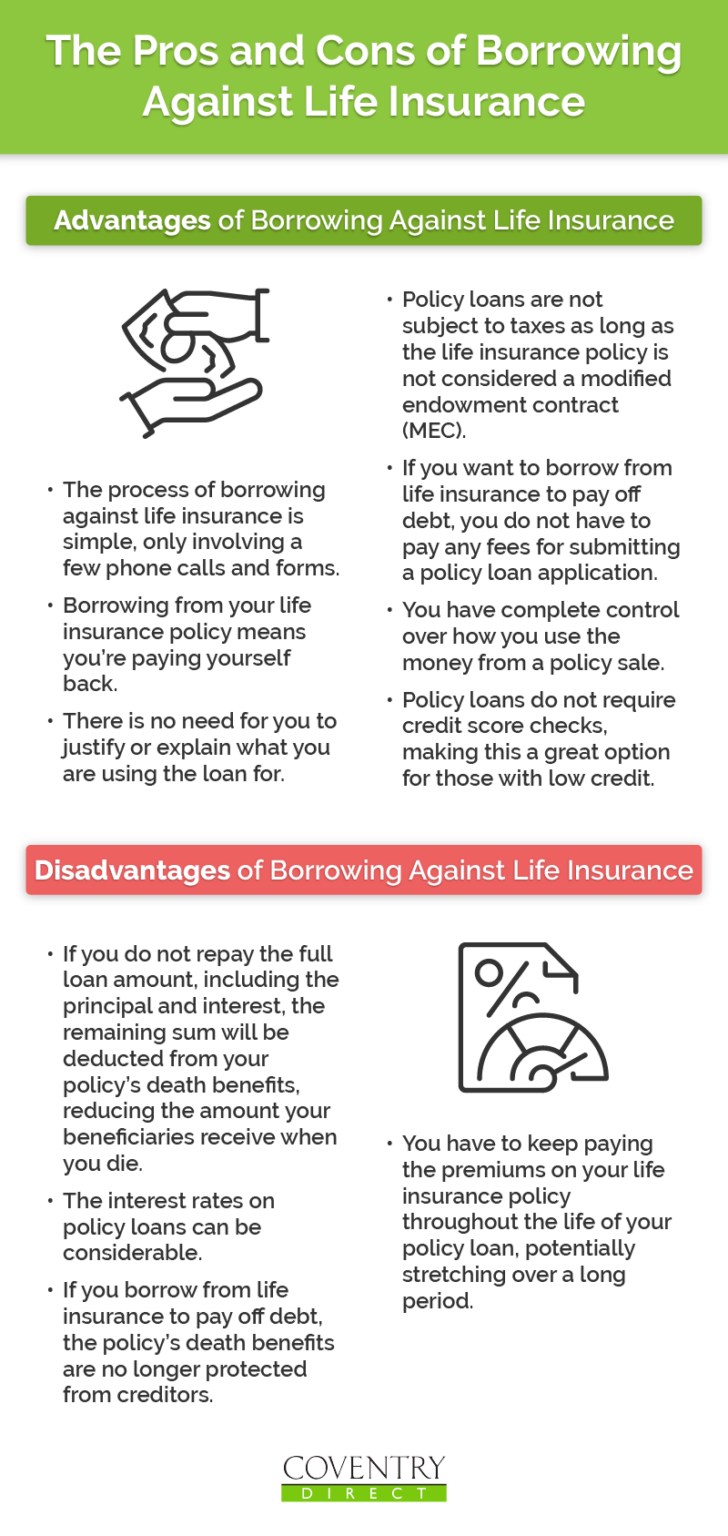

What Are the Pros and Cons of Borrowing Against Life Insurance?

Borrowing against life insurance offers policyowners a way to resolve their most pressing debt—but this benefit comes with tradeoffs. Like most financial transactions, this method of extracting cash from your life insurance policy isn’t for everyone. Before beginning the simple process of pursuing a policy loan, it is best to consider an overview of this financing solution’s advantages and disadvantages. With forethought about your financial situation and research about policy loans, you can determine whether borrowing against life insurance is right for you.

Pros of Borrowing Against Life Insurance

- Policy loans are not subject to taxes as long as the life insurance policy is not considered a modified endowment contract (MEC).

- If you want to borrow from life insurance to pay off debt, you do not have to pay any fees for submitting a policy loan application.

- You have complete control over how you use the money from a policy sale.

- Policy loans do not require credit score checks, making this a great option for those with low credit.

- The process of borrowing against life insurance is simple, only involving a few phone calls and forms.

- Borrowing from your life insurance policy means you’re paying yourself back.

- There is no need for you to justify or explain what you are using the loan for.

Cons of Borrowing Against Your Life Insurance

- If you do not repay the full loan amount, including the principal and interest, the remaining sum will be deducted from your policy’s death benefits, reducing the amount your beneficiaries receive when you die.

- The interest rates on policy loans can be considerable.

- If you borrow from life insurance to pay off debt, the policy’s death benefits are no longer protected from creditors.

- You have to keep paying the premiums on your life insurance policy throughout the life of your policy loan, potentially stretching over a long period.

If you find that the cons of borrowing against your life insurance outweigh the pros, your road to debt freedom does not have to end here. There are many ways to relieve yourself from debt through your life insurance—even if you have a fixed income. Selling your life insurance policy in a life settlement is a popular alternative many policyholders use to access a quick, generous payment in a time of financial distress.

A life settlement is the sale of your life insurance to a third party buyer who takes over premium payments in exchange for the policy’s death benefit. For the seller, this transaction provides a cash payout far greater than you would receive by surrendering your policy, sometimes reaching 50% of the policy’s death benefit. For those interested in exploring this option, Coventry DIrect specializes in helping seniors navigate the process of pursuing a life settlement through comprehensive guidance and educational resources. At Coventry Direct, you can even find out how much your life insurance policy is worth.

In Summary

Debt weighs on countless individuals every day—hurting their financial wellbeing, degrading their mental health, and detracting time and money from the things that matter most. From taking your mind away from precious family time to preventing you from paying crucial medical expenses, debt’s consequences can compound with time and undermine your family life and personal health. For those struggling under this burden, policy loans can provide a lifeline. Borrowing against life insurance is a quick and viable way to harness the value of your policy while you are still alive—saving you and your family from the strain of debt.

To continue learning about how to borrow from life insurance to pay off debt or determine whether a life settlement may be the better option for you, reach out to the experts at Coventry Direct today.