We all have to-dos to check off before we “kick the bucket”: places we want to visit, goals we want to achieve, people we want to spend more time with, and even indulgent purchases we want to make. Whether written or proverbial, these “bucket list” items tend to reflect our values and shape our golden years. A bucket list serves as a reminder of what’s important to us. It pushes us to the boundaries of our comfort zone and motivates us to achieve lifelong goals. Yet, just as no two people are the same, no two bucket lists are the same.

While some items are more commonly found on bucket lists than others, there are many factors that go into crafting a bucket list. Personal background, willingness to push boundaries, financial means, relationship status, mortality concerns: the list goes on. What’s more, generational differences form in nearly every aspect of our lives, and this topic is no different. At Coventry, we posed the question: what do bucket lists look like for each generation?

To find out, we surveyed over 1,500 Americans across age groups in August 2021 and analyzed the responses by generation. In the survey, we also tapped into the following retirement-themed questions:

- Would baby boomers prefer to spend their hard-earned savings on experiencing life today or leaving behind a financial legacy, passing on wealth to the next generation?

- Are Americans receptive to an encore career during their golden years, tied to an interest or passion?

- Do Americans have the financial means to check off bucket list items? What forms of retirement income do Americans have to lean on?

Read on to find out what we uncovered!

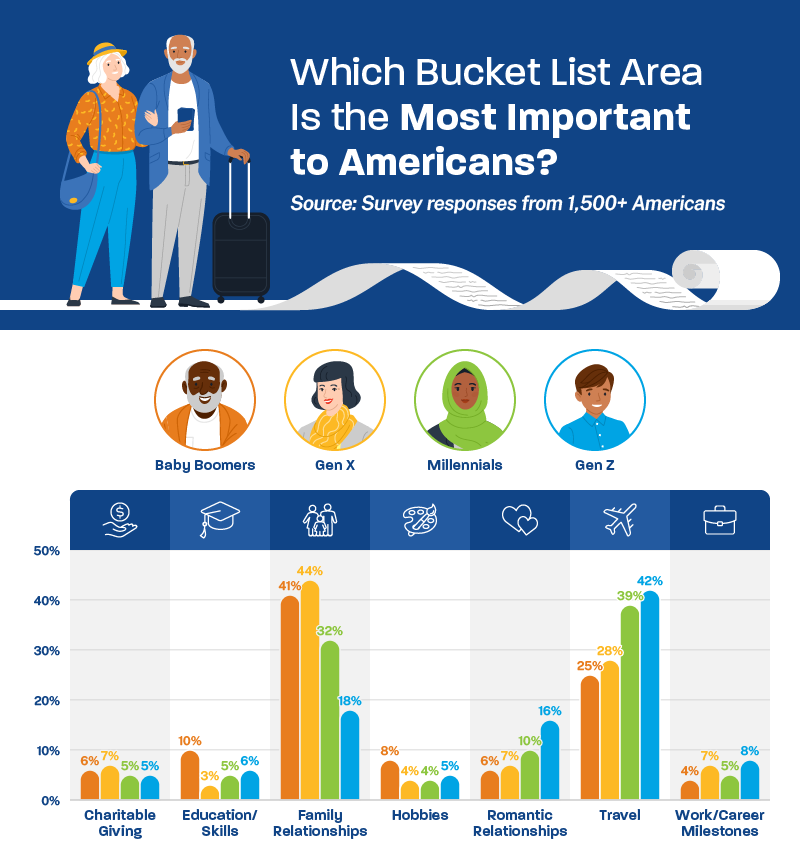

Family & Travel Top American Bucket Lists

Several generational differences exist when looking at bucket list opportunities. Deepening family relationships and travel were the most popular choices overall and highlight the difference in values by generation. Most notable are the differences between baby boomers and Gen Z respondents.

The majority of baby boomers (41%) say that family relationships are the most important area to focus on before they die, whereas only 18% of Gen Z respondents say the same. On the other hand, 42% of Gen Z respondents prioritize travel compared to only 25% of baby boomers. The results suggest that older generations value making memories with family most, while starry-eyed younger generations prioritize wanderlust when crafting a bucket list.

How Many Americans Keep a Bucket List?

Our survey found that two in five Americans keep a bucket list, but a majority (56%) are unable to complete the items on their bucket list due to financial constraints. A few of the financial setbacks preventing Americans from funding their bucket lists are a lack of retirement savings, credit card debt, rising cost of living, and even retiring earlier than anticipated due to health concerns tied to the pandemic. At this juncture, some Americans are finding it difficult to finance basic living expenses during retirement, let alone a bucket list.

Reid Buerger, CEO of Coventry, states that baby boomers, in particular, “want traditional, full retirement—with travel, time with the grandkids, hobbies and all––but with low interest rates and economic uncertainty, the challenge for this generation is how to fund a retirement that could span 30 years or more.”

Further, what happens to unfinished bucket lists? Do friends or family members pick up where another left off, finishing out their legacy? Our respondents did not seem to like the idea of passing on their unfinished list to another: especially baby boomers.

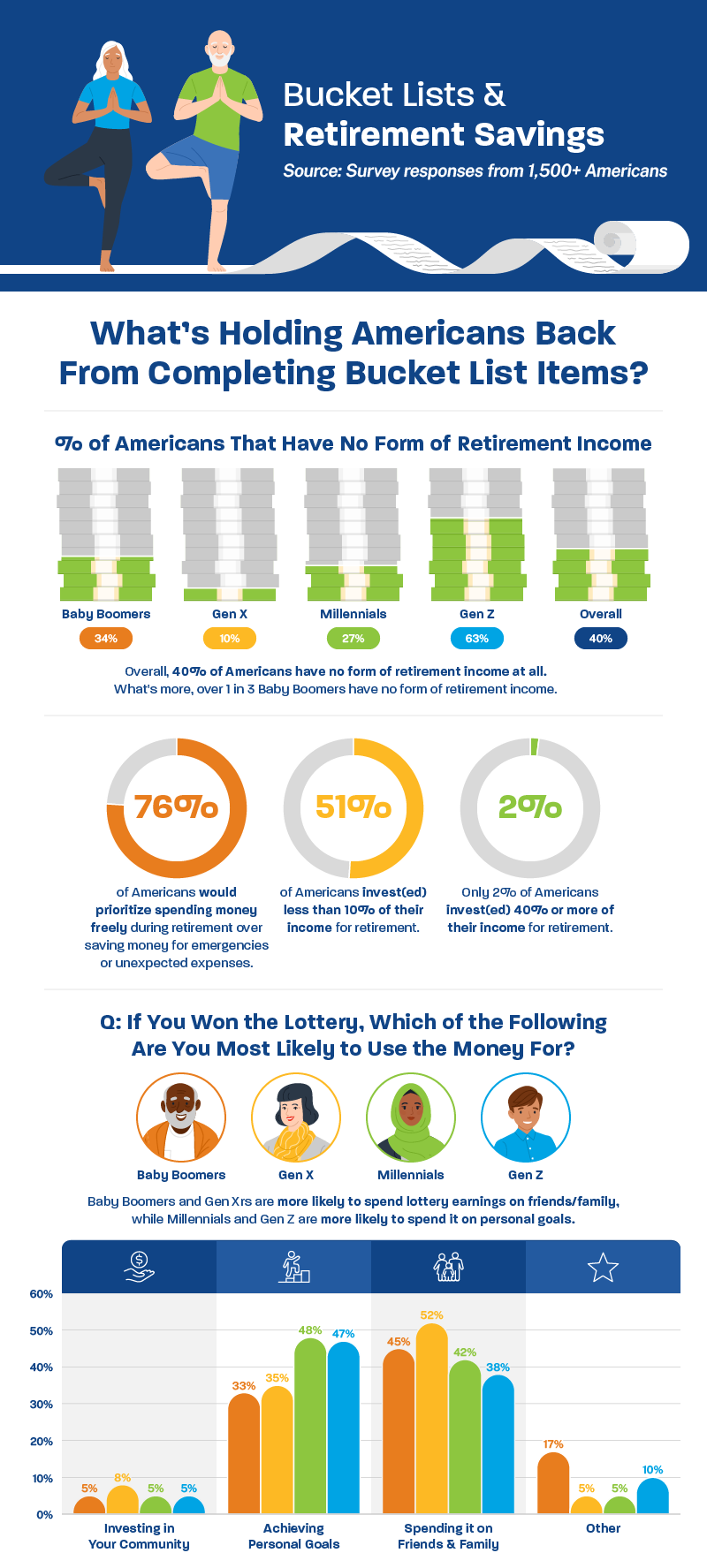

What’s Holding Americans Back From Completing Bucket Lists?

So, if Americans don’t want to pass on their bucket lists to others, what’s holding them back from completing their bucket list themselves? Money seems to be the overarching answer. Approximately 40% of Americans have no form of retirement income at all. What’s more, over 1 in 3 baby boomers have no form of retirement income: and this is the generation that is most likely to be retired!

The lack of retirement income is likely attributed to Americans’ financial priorities. 51% of Americans invested less than 10% of their income for retirement. Moreover, only 2% of Americans invested 40% or more of their income into retirement.

Pre-retirement financial decisions often line up with post-retirement choices. According to the survey, 76% of Americans would prioritize spending money freely during retirement over saving money for emergencies or unexpected expenses. COVID exacerbates this yearning even more. “Hamstrung by the pandemic, boomers are feeling ready to break out of the house and live large,” said Buerger.

So if more money appeared in their bank account from winning the lottery, how would Americans treat this cash? Again, we see a pattern when it comes to generational opinions. Baby boomers and Gen X respondents are most concerned about friends and family, whereas millennials and Gen Z respondents are most likely to spend the lottery loot hitting personal goals.

A Series of “Would You Rather” Questions, Answered

We decided to put our survey respondents’ values to the test by posing a series of “would you rather” questions. A year and a half into COVID-19, boomers ditch the idea of leaving a financial legacy, with an overwhelming majority (77%) saying they would rather spend their lifetime (and their money) making memories. While the Spend Kids’ Inheritance (SKI) movement is sometimes made out to be selfish, this couldn’t be further from the truth. Baby boomers’ desire to spend their life savings is born out of a longing to deepen family relationships. If anything, Boomers’ focus on building memories brings them into closer alignment with their millennial children, the “experiences, not things” generation.

Additionally, most Americans aren’t interested in working past age 65 to fund a richer lifestyle in retirement. Seventy-nine percent of Americans surveyed would rather work until 65 and live modestly versus working until 75 and living a more luxurious retirement. When it comes to encore careers, boomers, in particular, are ready to call it quits. When asked if they were clocking out permanently, most baby boomers (55%) say that they are not considering an encore career tied to an interest or passion

Final Thoughts

For seniors looking to uncover more retirement income to spend on experiences today, Coventry Direct is here to help you learn more about cashing in your life insurance policy. Every year, seniors allow $100 billion in life insurance policies to lapse. See if you qualify to sell your life insurance, and start making memories with the people that matter most.