Deciding where to spend your retirement is one of the biggest decisions people face as they approach their golden years, and for many, senior living communities offer a perfect balance of convenience, care, and camaraderie. But where you choose to live can greatly impact how much you’ll spend. From luxury options in bustling cities to affordable choices in smaller towns, the cost of senior communities varies widely across the U.S.

To learn more about these communities and their cost fluctuations, we explored data on 55+ living communities to find out where senior living is the most expensive, the most affordable, and the most widely available. Our analysis is based on data from the 100 best cities to retire, where we compared average rents in senior communities to citywide averages and identified the cities with the highest density of senior living options.

We hope this study offers some insight for anyone planning for retirement or considering their next move.

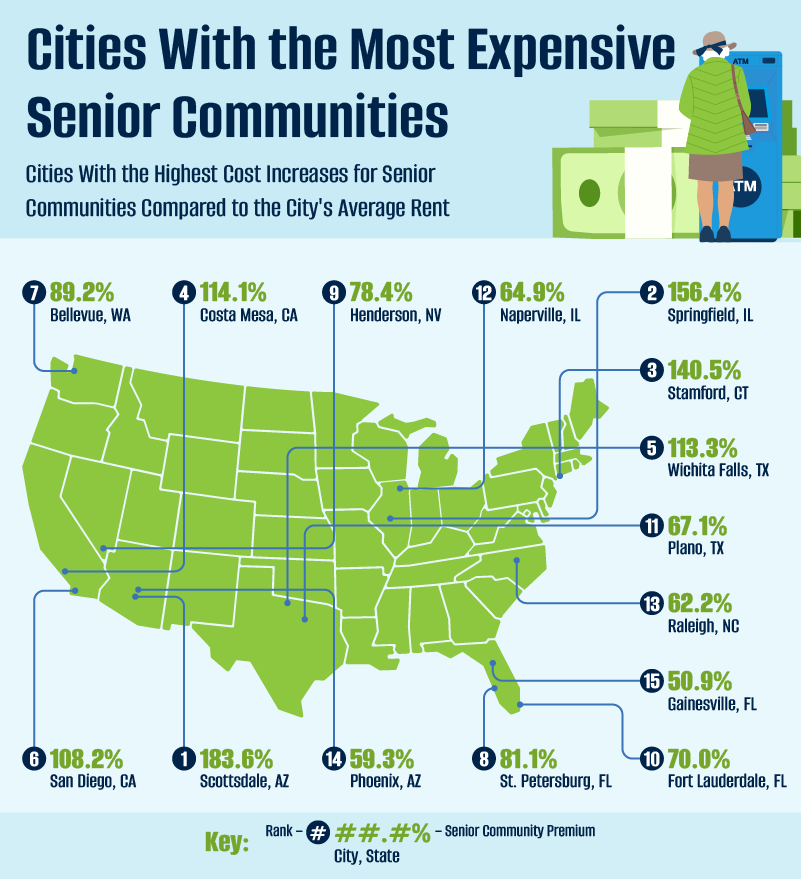

Where Do Americans Pay the Highest Premium for Living in a Senior Community?

Senior living communities offer older Americans a wealth of amenities and social opportunities, making them a very appealing option for many. However, the convenience and age-constrained accommodations can come at a hefty price tag. On average, residents in the cities we analyzed pay 23.7% more to live in a senior community than the average nearby rent.

That figure can vary quite a bit depending on where you live, with premiums well over 100% in some cities across the country. Here’s a closer look at where living in a senior community comes with the highest increased costs.

Cities With the Highest Premiums on Senior Communities

- Scottsdale, AZ: 183.6% higher than the average rent

- Springfield, IL: 156.4%

- Stamford, CT: 140.5%

- Costa Mesa, CA: 114.1%

- Wichita Falls, TX: 113.3%

These cities highlight a significant disparity between senior living community costs and average city rents. Scottsdale, known for its upscale retirement communities and amenities tailored to active retirees, tops the list, with residents paying nearly twice the city’s average rent. Similarly, Stamford’s proximity to large northeastern metropolises like New York City may contribute to its high premium, as retirees seek great amenities without sacrificing urban access.

- San Diego, CA: 108.2%

- Bellevue, WA: 89.2%

- Saint Petersburg, FL: 81.1%

- Henderson, NV: 78.4%

- Fort Lauderdale, FL: 70%

The second half of the list showcases popular retirement destinations in Florida like Saint Petersburg and Fort Lauderdale, where warm climates and coastal living have appealed to retirees for decades — even if it does come with a substantial added cost. Two cities out West, San Diego, and Bellevue, also stand out for their combination of high demand and premium amenities, contributing to elevated costs.

Certain trends emerge from the data, with cities in the Sun Belt states and coastal areas appearing prominently. These locations often cater to retirees with amenities like golf courses, healthcare facilities, and a warm climate, driving up demand for senior living options. Conversely, smaller cities like Springfield and Wichita Falls show that high premiums aren’t exclusive to major metropolitan areas.

Living in a senior community can come with a hefty price tag depending on the city, highlighting the importance of location when considering senior living options. Next, we’ll explore the cities with the most senior living communities per capita to help identify where these communities are most accessible.

Where Are Senior Living Communities Most Available?

Now that we’ve established where senior living communities see the highest cost increases, we want to examine the cities where they’re found most frequently (normalized by population). For context, the cities we analyzed averaged one senior living community per 10K people.

Cities With the Most Senior Living Communities

- Fort Lauderdale, FL: 6.84 per 10K people

- Sandy Springs, GA: 5.41

- West Palm Beach, FL: 4.68

- Richardson, TX: 3.56

- Scottsdale, AZ: 3.16

Florida’s dominance in the list reflects its reputation as a retirement haven. Cities like Fort Lauderdale and West Palm Beach offer warm climates, proximity to healthcare, and vibrant senior ecosystems, making community something that’s quite easy to come by. Meanwhile, the inclusion of Scottsdale highlights its status as a popular destination for active retirees seeking high-quality living options and helps explain why premiums on these communities are so high in the area: demand.

- Pompano Beach, FL: 3.04

- Palm Bay, FL: 2.96

- Pittsburgh, PA: 2.83

- Miami, FL: 2.82

- Atlanta, GA: 2.53

The second group further illustrates Florida’s appeal, with cities like Pompano Beach, Palm Bay, and Miami catering to retirees seeking affordable and accessible options. Pittsburgh’s appearance suggests that senior living options aren’t limited to just warm climates, as retirees may also prioritize urban amenities and a variety of cultural offerings.

Florida dominates the list, cementing its status as a top retirement destination with a high density of senior living communities. Beyond the Sunshine State, cities in the Southeast and Southwest, such as Sandy Springs and Scottsdale, also stand out. These areas combine a retiree-friendly atmosphere with ample community options, making them attractive choices.

While starting your search for the perfect senior living option in Florida is a safe bet, there are great options with strong communities of older Americans available nationwide. Keep reading to find out where those options cost the most overall.

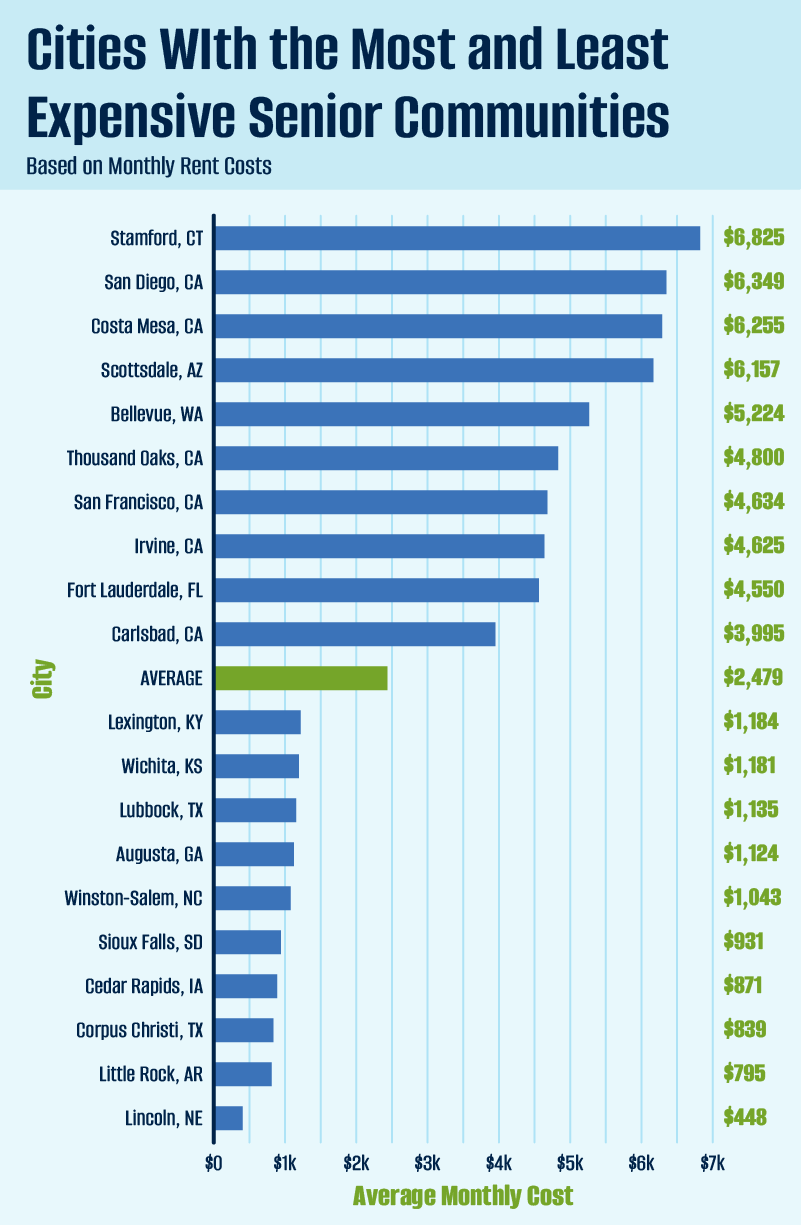

Cities Where Senior Communities Cost the Most

We’ve established that living in a senior community can be a wonderful choice for many older Americans, offering a vibrant social atmosphere. We’ve also learned that premiums on that lifestyle get very high depending on where you live.

Now, we want to round out the study with a look at where retirees pay the most for these communities, overall. On average, the monthly cost of senior communities across all the cities we analyzed is $2,479.

Cities With the Most Expensive Senior Communities

- Stamford, CT: $6,825

- San Diego, CA: $6,349

- Costa Mesa, CA: $6,255

- Scottsdale, AZ: $6,157

- Bellevue, WA: $5,224

These cities represent some of the most desirable locations for retirees, often combining luxurious amenities with high demand. Stamford’s centralized location in New England plays a role in its sky-high costs, while cities like San Diego and Costa Mesa offer year-round sunshine and a coastal lifestyle. Scottsdale’s growing reputation as a retirement hotspot also contributes to its elevated prices, while Bellevue’s thriving economy and quality of life attract retirees with deep pockets.

Cities With the Least Expensive Senior Communities

- Lincoln, NE: $448

- Little Rock, AR: $795

- Corpus Christi, TX: $839

- Cedar Rapids, IA: $871

- Sioux Falls, SD: $931

On the other end of the spectrum, these cities offer senior living options that are far more budget-friendly. Lincoln’s exceptionally low costs may be due to its smaller population and lower cost of living overall, while cities like Little Rock and Cedar Rapids provide affordable options without sacrificing quality of life. Retirees looking for affordability and charm might find these cities particularly appealing.

The data underscores a stark regional contrast, with the highest costs concentrated in coastal and metropolitan areas, while the most affordable options are often found in the Midwest and South. It’s important to balance location preferences with budget considerations when planning for senior living.

Closing Thoughts

Choosing to live in a senior community is a decision that many older Americans make to take advantage of benefits like tailored amenities and vibrant social opportunities. However, as we’ve discussed, costs can vary dramatically depending on the location, and access to these communities depends on where you’re looking to live. Some cities come with a steep price tag, while others provide more affordable options for retirees seeking quality living.

For those preparing for retirement, understanding these costs is a crucial step in planning for the future. That’s where Coventry Direct can help. By offering solutions like selling an unneeded life insurance policy, retirees can unlock additional financial resources to support their ideal retirement lifestyle. Whether you’re aiming to settle in a luxury community or a more budget-friendly option, we want to empower you to make choices that align with your financial goals.

Methodology

To determine the cities where senior communities cost the most, we analyzed the price difference between the average rent and senior community rent in America’s 100 best cities to retire, according to Niche.

We then compared the two rent costs to find out which cities see the largest increases in senior community costs and which see the largest decreases. We also found the number of senior communities per 10K people in each city.

All rent data comes from Zillow’s Observed Rent Index and all senior community data comes from After55.com.