In every sense, retirement is meant to be a stress-free and pleasant part of life, giving retirees a chance to celebrate their careers, explore their passions, and, most importantly, escape the stress of work. However, for every American planning to retire, the efforts needed to research retirement plans, budget savings, and accrue the funds create inescapable anxiety.

To complicate things even more, without one clear path to secure retirement, individuals are often left guessing at which saving strategies are best. Confused, many are left turning to equally unsure friends or scam-filled solutions, ultimately setting themselves up for failure.

At Coventry, we know that so often, financial confusion prevents Americans from making the best decisions about how to use their own money. Each day, we help individuals reassess how selling costly life insurance policies can help free up funds for things like medical care, living expenses, and, of course, retirement.

Given how much confusion around retirement financing we see each day, we wanted to get a better sense of how exactly Americans are managing their money for their futures. Therefore, we decided to conduct a survey to ask people about their saving habits, thoughts on retirement, and barriers to saving they’ve faced. We collected responses from over 1,500 individuals before analyzing the data to identify trends.

Altogether, we were able to gain some valuable insights about Americans’ retirement savings. We hope that these statistics can add some clarity to the confusing process of planning for the future.

A Look at Americans’ Saving Habits

First, we wanted to gain a general sense of Americans’ savings tendencies. After all, good habits around saving for major purchases can translate to good habits in saving for retirement.

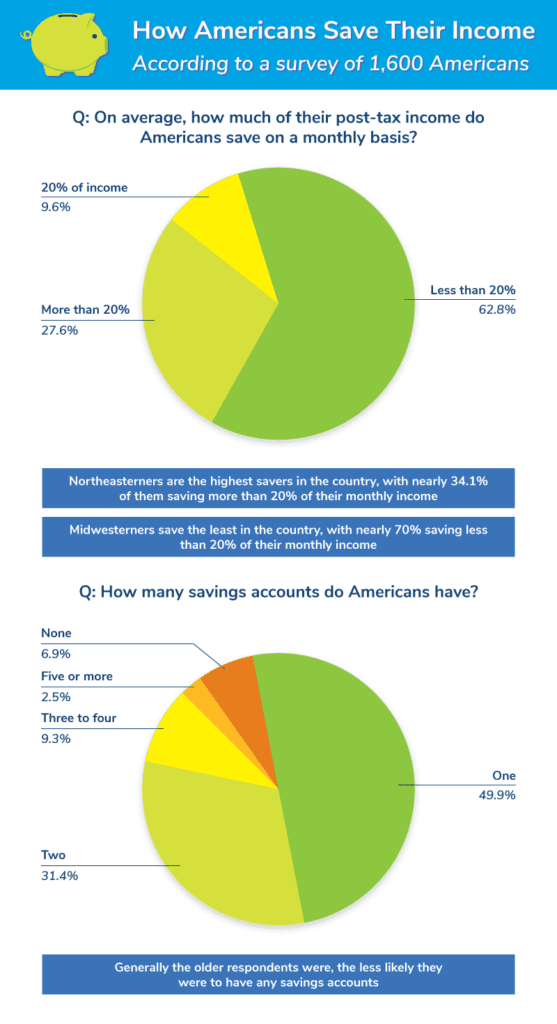

Most Americans are saving, though certain statistics suggest that the cut of monthly incomes going into savings accounts is limited. Most individuals save less than 20% of their monthly income and over 85% of individuals have two or fewer savings accounts.

It’s hard to blame anyone for putting small shares of their monthly income into savings. After all, living costs take precedence. However, those with some savings may want to consider investing in multiple savings accounts based on different savings goals.

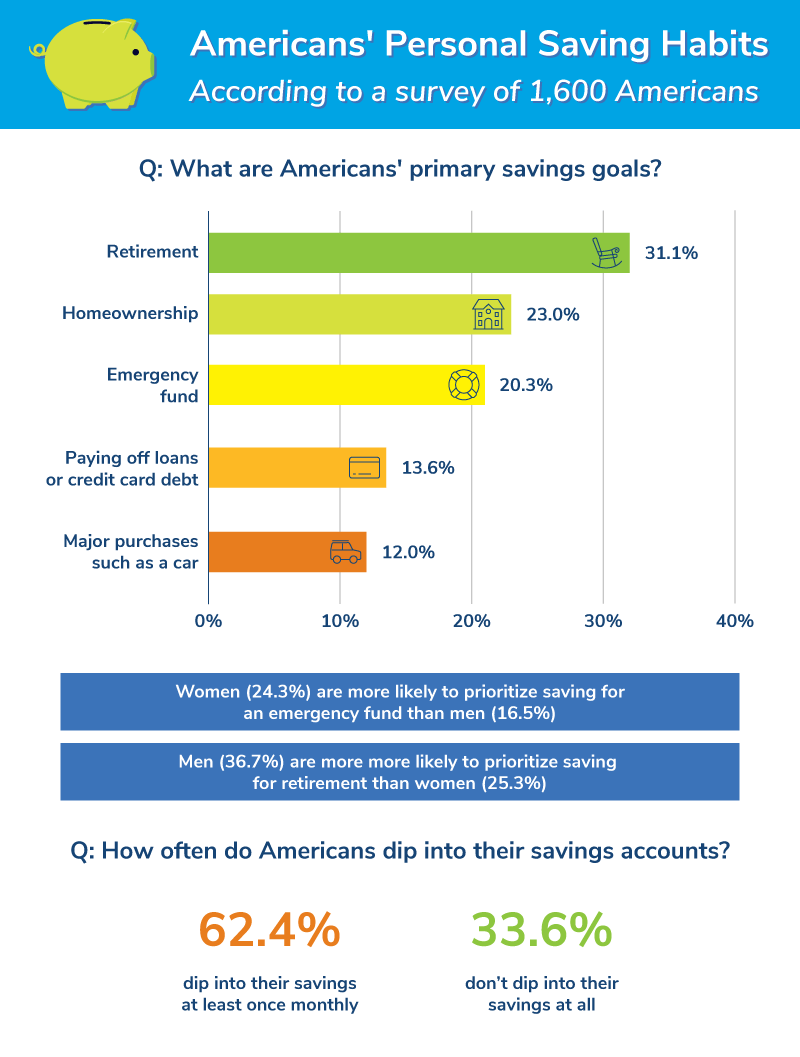

Speaking of unique saving goals, we also asked survey participants about what they’re saving for. Not surprisingly, retirement was Americans’ leading motivation for saving. Over 30% of respondents reported that retirement was their chief saving goal.

Interestingly, over 10% more men prioritized savings for retirement than women. On the other hand, more women prioritized saving for emergency funds. These contrasting priorities speak to a wider set of differences in how men and women manage finances that also is seen in total financial assets and investing choices.

Still, given that at least a quarter of both men and women are saving for retirement, it’s worth investigating which strategies are turned to for success.

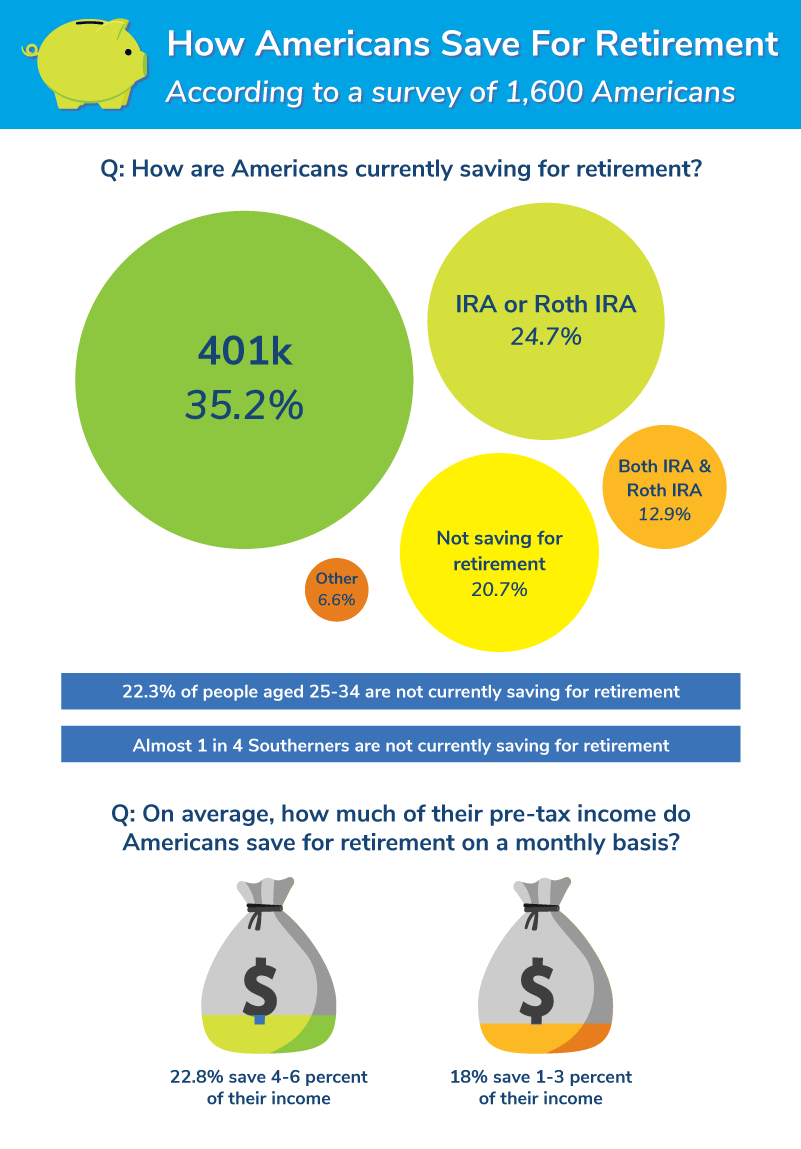

According to the respondents, the top method for retirement savings is through a 401(k). While many employers do offer a 401(k), which allows for direct deposit from an employee’s paycheck, there are certainly options for individuals whose employers do not offer the standard retirement plan, such as a tax-advantaged IRA.

However, only 12.9% of respondents held savings in both a 401(k) and an IRA or Roth IRA account.

We also noted that only 22.3% of people aged 25-34 are not saving for retirement. Reports on millennial job retention and savings suggest that this large amount of young people saving for retirement might be connected to employers hoping to hold onto employees.

Planning for Retirement: How Confident Do Americans Feel?

>Having gotten a better understanding of how much and with what tools Americans save for retirement, we then wondered: how confident are people about their retirement plans?

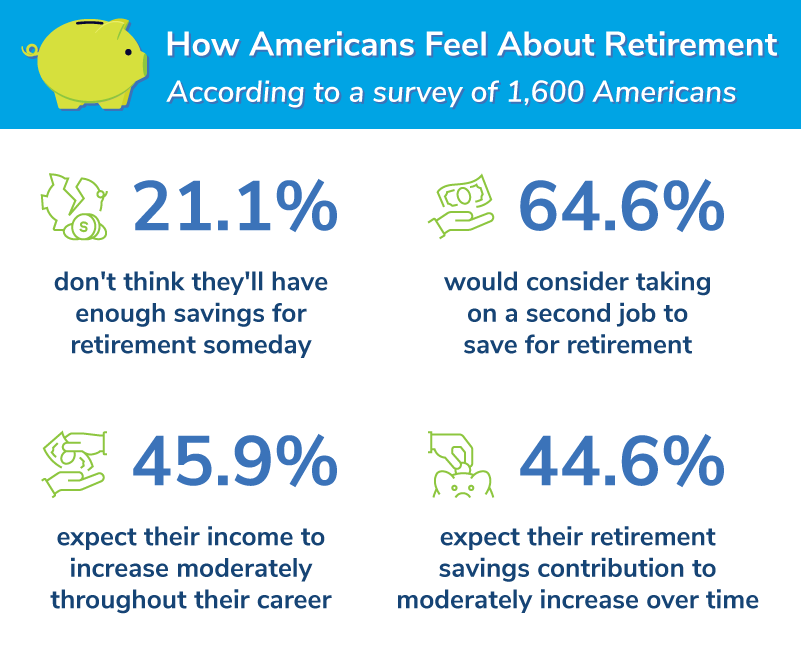

Disappointingly, the answer is pretty bleak. 1 in 5 respondents don’t think they’ll have enough money to retire and almost two-thirds of people would consider taking on a second job to make retirement a reality.

Interestingly, less than half of respondents expected things to improve. Only 45.9% of individuals expect their income to grow and only 44.6% of individuals expect that they’ll be able to put more of their monthly paycheck into retirement as time goes on.

Americans’ Most Common Barriers to Saving

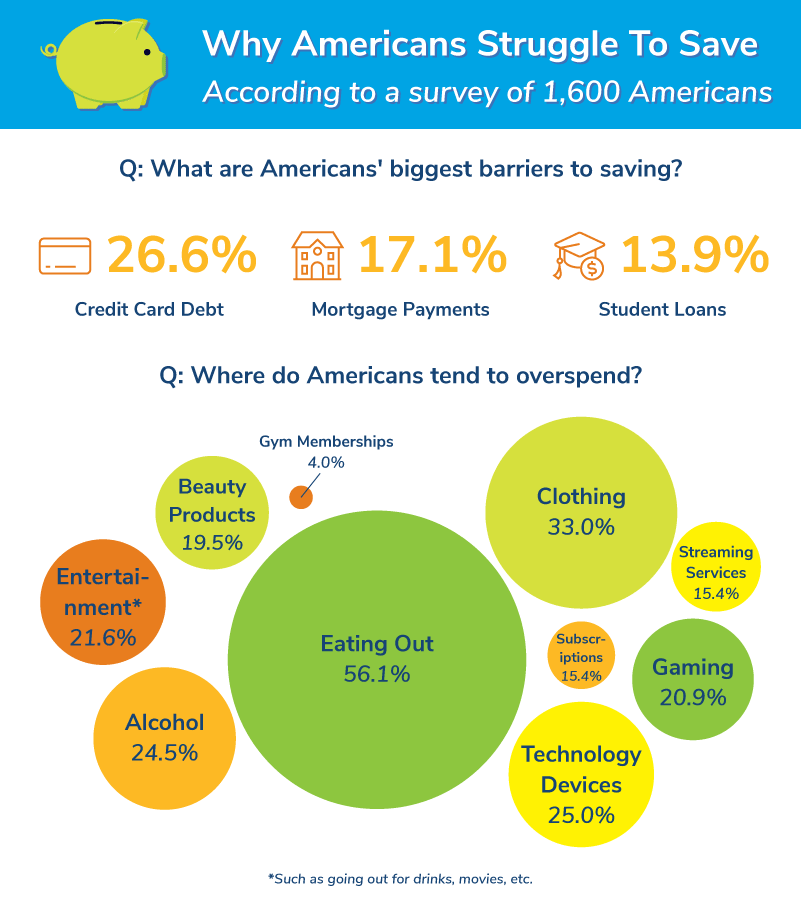

Of course, skepticism over salary increases is only partly to blame for Americans’ pessimism regarding retirement. Barriers to saving block even the most frugal Americans. Over 26% of Americans face credit card debt. Further, mortgage payments and overspending take out large chunks of monthly budgets.

Moreover, over 13% of the respondents reported that student loans were a barrier to saving. Reports show that over 44 million have student loans, meaning that the investment many take to begin their careers may block people from eventual retirement.

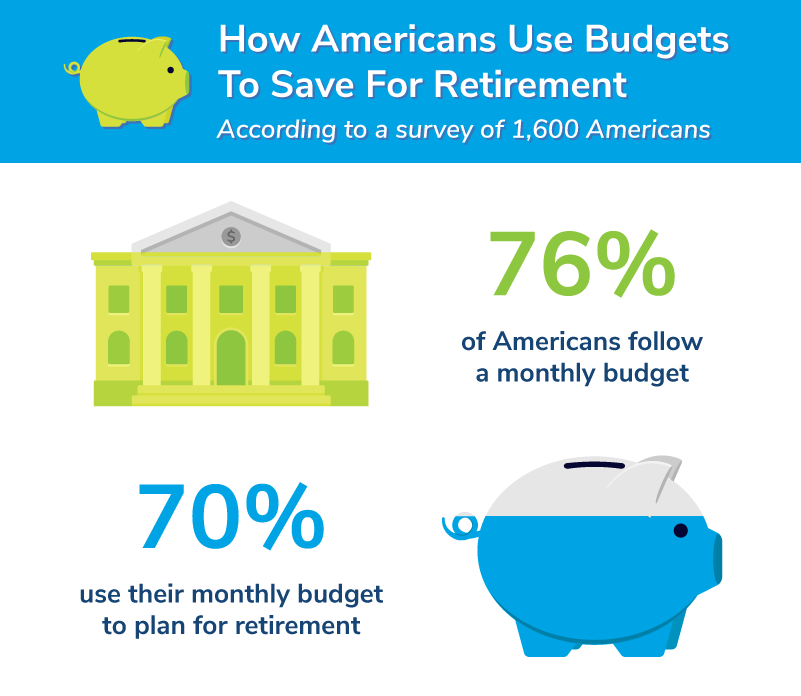

Still, people are looking to do their best. Over 75% of respondents follow a monthly budget, and 70% of those people work to plan their retirement with that budget. With that diligence and foresight, hopefully, individuals will be able to crunch their numbers and find solutions.

In fact, taking a hard look at your budget is crucial to making sure your money is being put into your priorities. At Coventry, we know that costly life insurance policies often take up far too much of the budget for the value that they bring to individuals. If you’re wondering whether your life insurance policy is worth its cost to you, you may want to consider how selling your life insurance policy can add value elsewhere. Coventry options can help you realize that value and maybe even find your retirement answers.